A New Age Inheritance Strategy That Could Change the Game for Future Generations

In the ever-evolving world of finance and technology, a new kind of trust fund is emerging, one that could potentially turn your kids into crypto millionaires while you’re still around to witness it. This isn’t your traditional trust fund, tucked away in stocks, bonds, or even classic savings accounts. We’re talking about a digital leap into the future with cryptocurrency – specifically, the Internet Computer Protocol (ICP). Crypto Guru Jerry Banfield shares the secrets of turning dollars into millions by multiplying time by new technologies to automatically create a wondrous bounty for a bright future of your heirs.

We strongly advise our readers to conduct thorough research and consider their financial situation, investment objectives, and risk tolerance before investing in cryptocurrencies. It is recommended to consult with a qualified financial advisor or investment professional to determine if this investment strategy aligns with your financial goals and risk profile. The value of cryptocurrencies can fluctuate dramatically, and there is a potential risk of losing your entire investment. By reading this article and considering its content, you acknowledge and agree that you are fully responsible for your investment decisions and any financial outcomes that may result.

The Vision: A Crypto Inheritance for the Digital Age

Imagine a world where your legacy isn’t just a sum of money left behind but a thriving, dynamic financial entity that grows and evolves even after you’ve passed it on. This is the vision behind the crypto trust fund strategy, a concept that’s gaining traction among forward-thinking parents and guardians.

Why Internet Computer Protocol (ICP) Stands Out

The Internet Computer Protocol (ICP) is emerging as a frontrunner in this new inheritance strategy. But why ICP, you might ask? The answer lies in its unique properties:

- Potential for Indefinite Growth: ICP is designed to appreciate over time, making it an ideal candidate for long-term investment.

- Drastically Undervalued: Currently, ICP is believed to be undervalued, presenting a golden opportunity for early investors.

- Staking Rewards: ICP offers staking rewards, allowing you to earn while holding onto your principal investment.

The Strategy: Locking in Your Child’s Future

The process is straightforward yet revolutionary. By setting up an account in the Network Nervous System on ICP, you can lock a significant amount of ICP (say, 1,000 units) for a period (like 8 years). This locked-in amount not only has the potential to appreciate significantly but also earns staking rewards, compounding the investment.

The Magic of Compounding and Staking Rewards

With an APR of around 16%, the power of compounding in this scenario is immense. You can choose to reinvest these rewards back into the principal, exponentially increasing the value of the trust fund. Alternatively, these rewards can provide a steady income stream for your children, starting right now.

Setting It Up: A Bonding Experience

Creating a crypto trust fund for your child isn’t just a financial decision; it’s an educational journey. It involves teaching them about investing, the power of compounding, and the future of finance. By setting up their account on a device they use, you’re also instilling a sense of responsibility and ownership.

The Minimum Investment: Tailoring to Your Capability

While 1,000 ICP is an ideal target, the plan is flexible. Even a smaller amount, like 300 ICP, locked in for an extended period, can potentially grow into a substantial sum, especially if the price of ICP appreciates as predicted.

The Long-Term Vision: Beyond Immediate Gains

This strategy isn’t about quick wins. It’s about playing the long game, betting on the future of technology, and the role of ICP in reshaping the internet. It’s about setting a foundation that your children can build upon, offering them a head start in a world where digital finance could be the norm.

A Word of Caution: Do Your Own Research

As with any investment, especially in the volatile world of crypto, it’s crucial to do your due diligence. This article isn’t financial advice but rather a spark for your own research and decision-making. The crypto market is unpredictable, and while ICP shows promise, it’s essential to understand the risks involved.

The Parental Perspective: A Legacy of Financial Wisdom

For parents, this strategy offers a unique opportunity to leave a legacy that extends beyond mere wealth. It’s about imparting financial wisdom, instilling values of investment and patience, and potentially setting your children up for a future of financial independence.

The Future-Proofing Aspect

Investing in ICP as a trust fund for your kids is more than just hoping for financial gains; it’s about future-proofing their inheritance. Unlike traditional assets, ICP’s potential in the evolving digital world could safeguard its relevance and utility, making it a more robust long-term investment.

The Emotional Reward: Watching Them Thrive

Perhaps the most compelling aspect of this strategy is the emotional reward. Unlike traditional inheritances, where benefits are realized posthumously, this approach allows you to witness your children enjoying and benefiting from your foresight and investment. It’s not just about leaving wealth; it’s about sharing in the joy it brings to their lives.

A Balanced Approach

While the idea of making your kids crypto millionaires is enticing, it’s crucial to maintain a balanced approach. Diversification remains a key principle in investing, and putting all your eggs in the ICP basket might not be wise. Consider this strategy as part of a broader financial plan for your family’s future.

A New Era of Inheritance

The crypto trust fund, particularly through Internet Computer Protocol, represents a paradigm shift in how we think about inheritance. It’s a blend of financial planning, technological adoption, and parental guidance. As we step further into the digital age, strategies like these could become the norm, reshaping how we secure our children’s future in an increasingly digital world.

Remember, the journey of a thousand miles begins with a single step. Whether that step is into the realm of ICP or another promising digital asset, the key is to start somewhere. Your children’s millionaire future might just be a well-researched investment away.

Request a free list of the most newest investments for 2024. Fill out the online form.

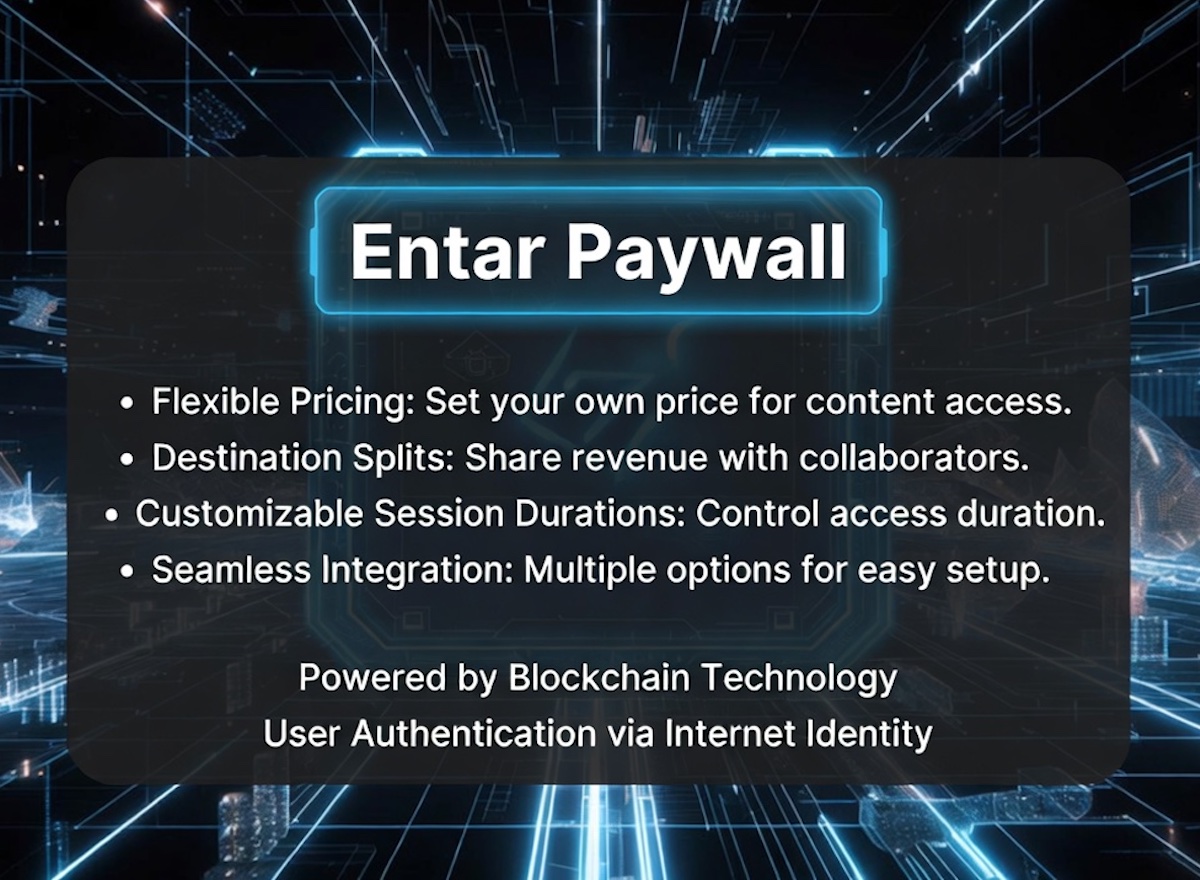

Copyright © This free information provided courtesy Entar.com with information provided by Corey Chambers, Broker DRE 01889449. The information provided in this article regarding the Crypto Trust Fund, particularly involving Internet Computer Protocol (ICP), is intended for educational and informational purposes only. It should not be construed as financial, legal, or investment advice. Cryptocurrency investments, including those in Internet Computer Protocol (ICP), are inherently risky and subject to high market volatility. Past performance is not indicative of future results. The views, thoughts, and opinions expressed in the article belong solely to the author, and not necessarily to the author’s employer, organization, committee, or other group or individual. The author and publisher of this article are not responsible for any financial losses or gains you may experience as a result of investing in cryptocurrency. Investors should be aware that the regulatory landscape of cryptocurrency is still evolving, and they should stay informed about changes in laws and regulations that could impact their investments. For more information, contact 888-240-2500.