In the grand theater of global finance, where titans like the U.S. Dollar and the Euro once reigned supreme, a new protagonist has emerged from the digital shadows: Bitcoin. Once dismissed as a fleeting experiment, this decentralized digital currency has not only challenged but is poised to eclipse the traditional monetary giants. | ENTAR INVESTMENT NEWSLETTER

The Stunted Euro

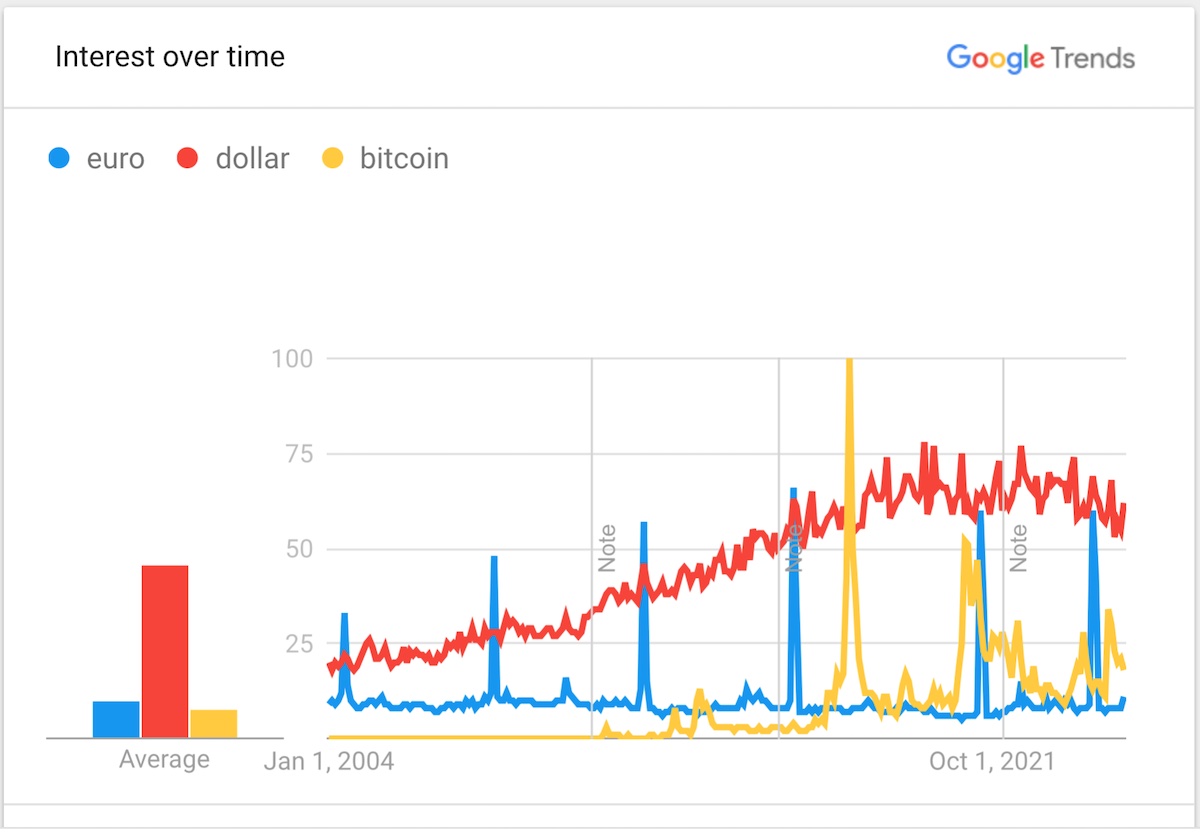

Look very closely at the chart, and see that the Euro was not destined for greatness. It never had any trajectory momentum. It was just there, servings its purpose with a modicum of respect as an alternative to the dizzying beehive of ever-fluctuating European currencies and their ever tedious mess of conversions. The Euro stayed stunted in growth of its cachet because Europe had already put the kibosh on its own growth long ago — choosing instead regulation, taxes, excess socialism and protectionism.

📉 The Apex and Decline of the U.S. Dollar

December 2019 marked the zenith of the U.S. Dollar’s dominance in global search interest, as per Google Trends data. The onset of the COVID-19 pandemic in early 2020 disrupted global economies and eroded confidence in centralized financial systems. The ensuing economic uncertainties and unprecedented fiscal policies led to increased skepticism about traditional financial systems, setting the stage for alternative assets like Bitcoin to gain traction. The printing presses spun up to dizzying RPMs as the helicopters began to drop trillions. History’s most convenient scapegoat had arrived just in time. A bad flu season was promoted as the “invisible enemy.” No need for humans to be held economically accountable, when the politicians, fake news and corrupt health care industry could so conveniently blame something that is not quite even alive. The virus hysteria thereby sounded the death knell of the U.S. Dollar.

📈 Bitcoin’s Meteoric Rise

By October 2023, Bitcoin’s search interest had notably increased, reflecting its growing acceptance and the public’s curiosity about decentralized finance. This surge can be attributed to several factors:

- Institutional Adoption: Major financial institutions began integrating Bitcoin into their portfolios, lending credibility to the asset.

- Technological Advancements: Improvements in blockchain technology and increased accessibility through user-friendly platforms made Bitcoin more approachable to the average consumer.

- Economic Factors: Concerns over inflation and the stability of traditional currencies prompted individuals to explore alternative stores of value.

🔮 Projecting the Future: Bitcoin vs. U.S. Dollar

Analyzing current trends, it’s plausible to anticipate that Bitcoin’s search interest could rival or even surpass that of the U.S. Dollar within the next three to six years. This projection is based on:

- Continued Technological Integration: As blockchain technology becomes more embedded in various sectors, public interest in Bitcoin is likely to grow.

- Global Economic Shifts: Ongoing economic uncertainties may drive more individuals towards decentralized financial systems.

- Demographic Changes: Younger generations, more attuned to digital technologies, may favor cryptocurrencies over traditional fiat currencies.

Look at the bottoms of the trend lines: Interest in the dollar has been waning for years, as excitement for Bitcoin grows. In a few years, nobody will want to talk about dollars. They’ll be a memory of what once was.

🏁 Bitcoin To Replace the Dollar

Bitcoin’s journey reflects a broader transformation in the global financial landscape. Its rising search interest underscores a growing public inclination towards decentralized and digital financial solutions. The USD is only worth about 3% of its original value. Much of the dollar’s decline happened after the USD was completely removed from the gold standard by Nixon, enabled by an ever-present cadre of pro-war democrats, in favor of the unsuccessful Vietnam massacre and other useless, failed wars to come. The once mighty dollar had gradually become primarily a tool for war and central control, diminishing its once powerful role in efficient resource distribution and wealth creation for the middle class. While traditional currencies like the U.S. Dollar and the Euro have held dominance for decades, they days are numbered. The purchasing power of the USD is diminishing faster and faster. More and more of its players want out. When new, a dollar could buy a big dinner for a large family. Today, the greenback is worth close to zero — only 0.00001 BTC. That barely enough to buy one bite of food. One bitcoin, when new, could not even buy a gum ball. Now, it can buy a top-of-the line Tesla. The evolving economic and technological environment suggests a future where Bitcoin plays a central role in global finance.

Stay ahead of the trends to profit from the wave of technology. Fill out the online form.

Copyright © This free information provided courtesy Entar.com with information provided by Corey Chambers, Broker DRE 01889449. We are not associated with the seller, homeowner’s association or developer. For more information, contact 888-240-2500 or visit WeSellCal.com Licensed in California. All information provided is deemed reliable but is not guaranteed and should be independently verified. Text and photos created or modified by artificial intelligence. Properties subject to prior sale or rental. This is not a solicitation if buyer or seller is already under contract with another broker.