TECH NEWS — In the ever-evolving and Wild West-like landscape of cryptocurrency, the line between innovative investment opportunities and outright scams can sometimes become perilously thin. The case of Forsage is a stark reminder of this precarious balance, a cautionary tale that underscores a fundamental truth in the world of digital currency: if you’re investing in crypto, especially if you’re trusting it to a third party for safekeeping, it should only be with money you can afford to lose.

The Alluring Promise of Forsage

Forsage entered the crypto scene with a proposition that was as enticing as it was revolutionary: a decentralized finance (DeFi) platform that promised to democratize wealth through a crowdfunding-like structure. It was a pitch perfectly tuned to the times, resonating with the anti-establishment ethos that has fueled the rise of blockchain technology. Forsage claimed to leverage the power of smart contracts to create a self-sustaining matrix of financial growth — a utopian vision of a community-driven wealth machine.

The Harsh Reality: A $340 Million Mirage

But beneath the veneer of techno-optimism and community empowerment, a more sinister reality lurked. On February 22, 2023, the illusion was shattered when a federal grand jury indicted the four founders of Forsage, exposing the operation for what it truly was: a Ponzi and pyramid scheme wrapped in the seductive guise of DeFi innovation, according to federal law enforcement. This fairness-minded article will also later discuss the Forsage founder’s side of the story.

The indictment laid bare the mechanics of the scheme: Forsage’s smart contracts, rather than being the engines of a decentralized economy, were programmed to perpetuate a cycle of fraud. New investors’ funds were funneled to earlier participants, the classic hallmark of a Ponzi scheme. The promise of low-risk and high returns was a mirage; the reality was that the vast majority of investors ended up with less than they put in, if they received anything back at all.

The Fallout: A Global Web of Deception

The U.S. Department of Justice’s accusation of Forsage’s fraudulent nature has sent shockwaves through the crypto community. The scheme’s global reach, with victim-investors around the world, has made it a stark emblem of the dangers lurking in the unregulated corners of the crypto economy. The indictment has also highlighted the sophistication with which these modern charlatans operated, using blockchain’s inherent complexities to obscure their deceit, according to the accusers.

The Lesson: Due Diligence in the Digital Age

The Forsage debacle serves as a potent reminder of the importance of due diligence in the age of digital assets. The allure of quick returns and the revolutionary rhetoric of decentralization can easily cloud judgment. Investors must navigate this new financial frontier with a healthy dose of skepticism and a rigorous commitment to research. The tools of blockchain analysis and the vigilance of law enforcement are critical allies in this endeavor, but the first line of defense is always an informed and cautious investor.

The Path Forward: Accountability and Awareness

As the legal process unfolds, with the founders of Forsage facing serious charges, there is a collective reckoning within the crypto space. This incident has underscored the need for greater transparency and realistic regulatory frameworks that can keep pace with the rapid innovation of DeFi. It has also highlighted the critical role of investor education and the need for a community-wide commitment to ethical practices. Founder Vladimir Okhotnikov ( AKA Lado ) and the other suspects are innocent until proven guilty in a court of law. Lado claims that Forsage is super transparent, and that nobody was tricked, fooled or defrauded, as the code is public.

A Stark Reminder

The Forsage saga is a stark reminder of the risks inherent in the nascent world of cryptocurrency. It’s a world brimming with potential but also fraught with hazards. As we collectively navigate this uncharted territory, the Forsage failure should be etched in our memories as a warning: in the pursuit of digital gold, let us not be blinded by the glittering promises of false prophets. Let us move forward with caution, wisdom, and a renewed commitment to integrity in the crypto ecosystem.

The Mechanics of Forsage: A Deep Dive into the Deceptive Scheme

Forsage, on its surface, presented itself as a revolutionary platform in the world of decentralized finance (DeFi). It was marketed as a peer-to-peer crowdfunding project, utilizing the immutable and transparent nature of blockchain smart contracts to facilitate money exchanges directly between participants. However, beneath this facade of innovation and financial democratization, Forsage operated as a classic pyramid and Ponzi scheme, exploiting the allure of cryptocurrency as a cover for its fraudulent activities, according to the Cornell Study

Recruitment as the Core Engine

The primary engine driving Forsage was recruitment. The scheme was heavily reliant on existing participants recruiting new ones, a hallmark of pyramid schemes. The training materials, such as the primary training video, emphasized strategies for promoting Forsage using free social media tactics. Participants were encouraged to craft messages that highlighted the simplicity, effectiveness, and lucrative potential of the project, often sharing personal success stories or those of their team members to entice new recruits.

Social Media: A Conduit for Expansion

Social media platforms were the lifeblood of Forsage’s expansion. Members were instructed to use platforms like Facebook, Instagram, Twitter, and YouTube to spread the word about Forsage. They were given scripts to initiate conversations, with the aim of piquing interest by asking contacts about their openness to new income streams. If interest was shown, they would share videos and testimonials that painted Forsage in a highly positive light, often glossing over the risks involved.

The Promise of Easy Money and Transparency

Posts from members boasted about the ease of making money with Forsage, the transparency and security provided by the smart contract, and the decentralized nature of the scheme, which purportedly made it invulnerable to shutdown or interference. They claimed that 100% of the funds went to members, with project creators not holding any money. This was a strategic move to build trust and suggest a level of security that wasn’t actually present.

The Reality of Smart Contract Functionality

The open-source code of Forsage’s smart contract was often cited as evidence of its legitimacy. According to the Cornell study however, the true functionality of these smart contracts was to automate the pyramid scheme’s transactions, ensuring that new investments were distributed to earlier investors, creating the illusion of profitability while actually depending on a constant influx of new money to sustain itself.

The Illusion of a Self-Sustaining System

Members were led to believe that they were part of a self-sustaining system that could generate income indefinitely. The narrative was that as long as new recruits kept coming in, everyone would be able to earn significant returns on their initial investments. This is a common tactic in pyramid schemes, where the focus is on recruitment to generate returns rather than legitimate business activities or investments.

The Role of Touching Stories and Testimonials

Forsage also used emotional appeal through touching stories and testimonials. Videos were shared that showcased success stories, creating a narrative of transformation and opportunity. These testimonials were powerful marketing tools, designed to lower the guard of potential recruits by presenting relatable success stories.

The Recruitment Strategy: A Numbers Game

The recruitment strategy was a numbers game, as highlighted by the instructions given to members. They were told to expect a small success rate, with roughly one positive response for every nine rejections. Persistence was key; members were encouraged to continuously reach out to new prospects, with the expectation that sheer volume would eventually yield new recruits. Nothing unusual here, as this is the case with most sales-related pursuits.

The Inevitable Collapse

Despite the aggressive marketing and recruitment strategies, the fundamental flaw in Forsage’s design was that it was not sustainable. Like all pyramid schemes, it relied on an ever-increasing number of recruits to fund returns, which is impossible to maintain over time. When the recruitment slowed, the scheme collapsed, leaving the majority of participants out of pocket, with only those at the very top having made significant earnings. (Did this happen to Forsage, or did it run fine until the feds shut it down? Is Forsage still running fine on Ethereum? Forsage.com is down in the U.S. Can some users still access it?) More success at the top, along with limited life span, is a true fact with most pyramid-shaped enterprises, but most business have limited lifespans, and most businesses pay more to the people on top. The American social security system is also said to be composed of the same doomed pyramid strategy. Should Social Security be illegal?

A Lesson in Vigilance

The Forsage scheme serves as a stark reminder of the importance of vigilance in the cryptocurrency space. While the technology behind blockchain and smart contracts holds great promise, it can also be used to lend a veneer of legitimacy to fraudulent schemes. Investors must approach such opportunities with a critical eye, recognizing that high returns promised with little risk or effort are red flags indicative of potential scams. As the Forsage case demonstrates, when it comes to investments, if it seems too good to be true, it probably is.

The Transparency of Code: Analysis by Cornell

The summarized content from the PDF titled “Forsage: Anatomy of a Smart-Contract Pyramid Scheme” provides a comprehensive analysis of Forsage, a pyramid scheme implemented as a smart contract, primarily on the Ethereum blockchain, and also on Tron. Here are the key points from the summary:

- Introduction to Forsage:

- Forsage is a pyramid scheme that operates as a smart contract on blockchains like Ethereum, which at its peak was one of the largest consumers of resources on the Ethereum network.

- The scheme’s transactions and code are visible on the blockchain, providing transparency that the study leverages to analyze the mechanics and impact of Forsage.

- Contract Deconstruction:

- Forsage promoters emphasize the transparency of the contract, with its source code being public.

- The study deconstructs Forsage to describe its dynamics, revealing it operates as a pyramid with a few users at the top benefiting from a larger base.

- Forsage transactions consume more gas than typical Ethereum transactions, making them more expensive for users.

- Contract Measurement Study:

- The flow of 721k ETH (around $226M USD) through Forsage from its creation to January 2021 was documented.

- Over 88% of Forsage players have lost money, with a small number at the top profiting significantly.

- Community Study:

- Marketing materials for Forsage make false claims of profitability and trustworthiness.

- The study analyzes promotional videos and social media to document tactics used to attract users and the geographical distribution of users.

- Smart Contracts and Ethereum:

- Forsage operates on Ethereum, where transactions are processed by contract code and are publicly visible.

- Ethereum’s native currency is Ether (ETH), and smart contracts are launched as bytecode in the Ethereum Virtual Machine (EVM).

- Solidity is the programming language typically used for writing Ethereum smart contracts.

- Forsage on Tron:

- Forsage has also been launched on Tron, another blockchain with smart contract functionality.

- Transparency and Trust Claims:

- Forsage’s promotional materials claim trustworthiness due to the open-source nature of the contract.

- However, despite the code being public, the study found the logic complex and required significant effort to analyze.

- Mechanics of Forsage:

- Forsage uses a matrix system for its pyramid structure, with two matrices called X3 and X4.

- Users earn money by recruiting others, and payments flow upwards within the pyramid.

- Forsage’s Accessibility:

- The Forsage website encourages the use of user-friendly cryptocurrency tools, making it accessible to novice users.

- Implications of the Study:

- The findings provide insights into the conception, mechanics, and evolution of smart-contract scams and financial scams more generally.

- The study suggests strategies for government authorities and the cryptocurrency community to combat pyramid schemes and other scams.

The study concludes that while Forsage’s smart contract code is indeed transparent, the scheme operates as a classic pyramid, with the majority of participants incurring losses. The transparency of the smart contract is used as a marketing tool to lure users with false claims of trustworthiness and profitability.

The Other Side of the Coin

Defending the creators of Forsage, one could argue that the transparency of the smart contract code on the Ethereum and Tron blockchains is a testament to the platform’s commitment to openness. Unlike traditional pyramid schemes that operate in the shadows, Forsage’s transactions and code are visible to anyone, suggesting a level of honesty in their operations. The use of Solidity and the deployment on widely respected blockchains like Ethereum and Tron could be seen as an effort to democratize investment opportunities and utilize the decentralized nature of blockchain to allow participants from all over the world to engage in what could be perceived as a communal financial activity. Furthermore, the complexity of the code, rather than being a tool for deception, could be interpreted as an innovative approach to digital marketing and network building, leveraging the capabilities of smart contracts to create a new business model in the era of blockchain technology.

Innocent Until Proven Guilty

It’s possible that the accusers may be placing too much emphasis on the history of pyramid structures, while ignoring the fact that all or most of the “victims” of Forsage were well aware that they would receive no payments until they recruited more than 3-6 others. From what we can tell, those who performed as required, did in fact receive the payments automatically as promised. The true and open transparency of the Forsage Solidity code is a type of disclosure, a potential legal protection against fraud charges. The fact that the services could be considered a type of crowdfunding may also present a valid legal defense for the accused.

Disclaimer

The content provided in this blog post discusses the events and circumstances surrounding the Forsage platform and is intended for informational purposes only. It is important to note that while Forsage has been indicted on charges of operating a global Ponzi and pyramid scheme, it has not been legally determined to be an illegal pyramid scheme by a court of law. All defendants in the Forsage case are presumed innocent until proven guilty beyond a reasonable doubt in a court of law. The allegations against Forsage are to be adjudicated through the legal process.

Blockchain technology, which underpins platforms like Forsage, is a groundbreaking and predominantly legitimate technological innovation that has numerous applications across various sectors. The majority of blockchain applications are legal, ethical, and contribute positively to technological advancement.

Furthermore, it is not uncommon for federal law enforcement to take preemptive action against websites and platforms by obtaining court orders to shut them down, sometimes before the legal process regarding the alleged activities is fully resolved. Such actions are typically taken to prevent potential harm or fraud and do not necessarily reflect the final legal status of the entities involved.

This disclaimer serves to remind readers that the legal status of Forsage is not final and is subject to the outcomes of ongoing legal proceedings. It is also a general reminder of the legitimacy and utility of blockchain technology, despite the potential for its misuse by certain actors.

Request a free list of the best investments during stagflation. Fill out the online form:

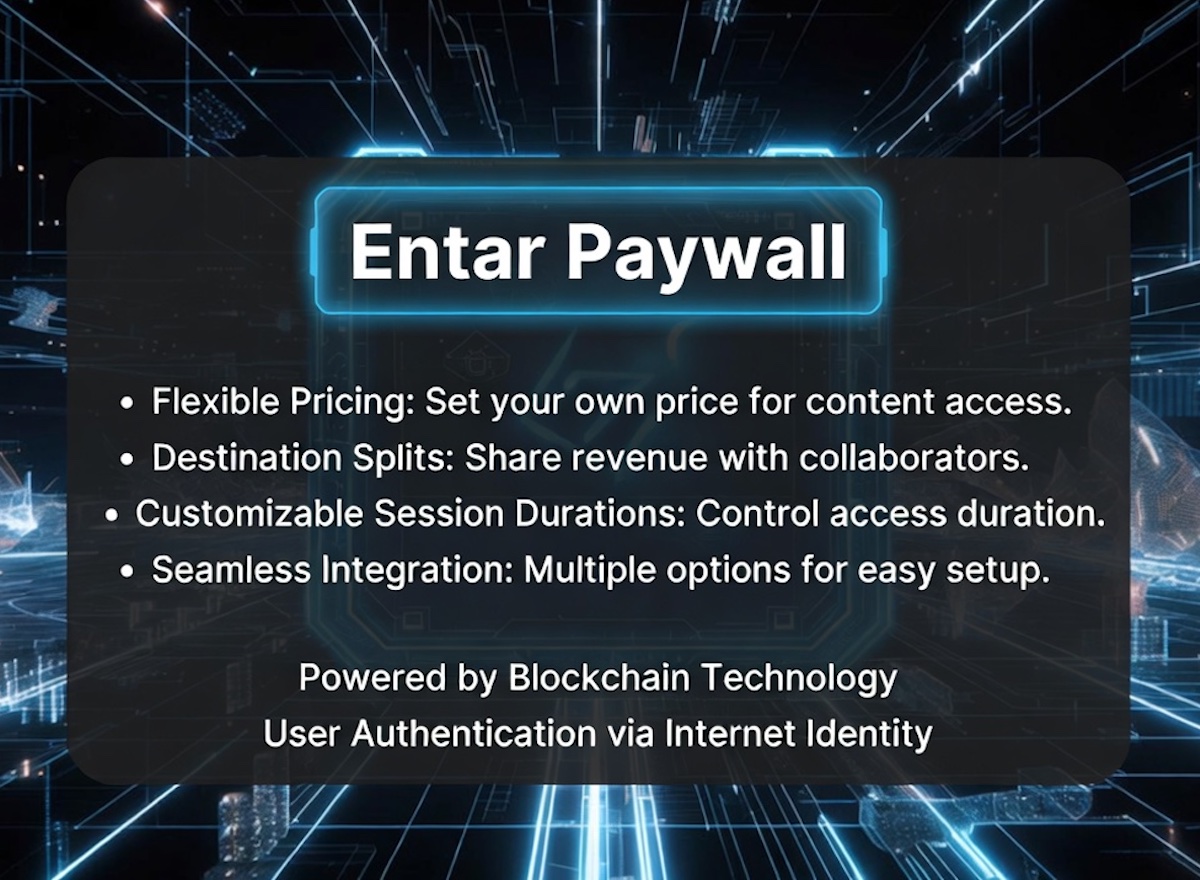

Copyright © This free information provided courtesy Entar.com with information provided by Corey Chambers, Broker DRE 01889449. We are not associated with the seller, homeowner’s association or developer. For more information, contact 888-240-2500 or visit WeSellCal.com Licensed in California. All information provided is deemed reliable but is not guaranteed and should be independently verified. Text and photos created or modified by artificial intelligence. Properties subject to prior sale or rental. This is not a solicitation if buyer or seller is already under contract with another broker.