From Bricks to Bullion to Bots

A Tale of Three Titans In the ever-evolving world of investment, the winds of change have continually reshaped the landscape. Once upon a time, real estate reigned supreme, symbolizing stability and tangible wealth. Then came the golden era of gold, glimmering with promises of security against economic turbulence. Today, we find ourselves at the dawn of a new epoch, where artificial intelligence (AI) stands as the vanguard of investment opportunities, transforming how we perceive and interact with the future of finance.

The Reign of Real Estate In 2006, the investment world was firmly grounded in real estate. This era was marked by a fervent belief in the infallibility of owning land and buildings. Real estate was more than just an asset; it was the cornerstone of wealth creation and preservation. The logic was simple and compelling: land is finite, and as populations grow, so too would demand and value.

The story took a dramatic turn with the 2008 financial crisis. The collapse of the housing market bubble served as a stark reminder of the sector’s vulnerability. Investors who had once viewed property as their safest bet were now faced with the harsh reality of plummeting values and uncertain futures, according to Financial Times.

In the shadow of the 2008 housing crisis, there was a mosaic of personal tragedies as the dream of homeownership turned into a nightmare for many. Among the saddest aspects were the stories of families who, lured by the promise of easy credit and the allure of a booming housing market, found themselves over-leveraged and underprepared for the financial strain that would follow.

One such story could be of a family who, perhaps encouraged by the availability of NINJA loans—no income, no job, no assets—invested in a home with the belief that it would be a stepping stone to a brighter future. As interest rates climbed and their adjustable-rate mortgage payments skyrocketed, the financial burden became unbearable. The Wharton School of Business explains the causes. The home that was once a symbol of success and stability soon became an anchor, dragging them down as the market collapsed and their property’s value plummeted far below what they owed.

The crisis wasn’t just about low-income families; it affected risk-takers across all income levels, including those who invested in second or third homes, hoping to cash in on the market’s upward trajectory. When the bubble burst, these investors found themselves with properties they could neither afford nor sell, leading to a cascade of foreclosures that would ravage neighborhoods and upend lives.

At the heart of many of these stories is a lesson about the dangers of overextension and the importance of prudence in borrowing. The long-term impact of the crisis was particularly acute for minority and low-income households, who were often the most vulnerable to the economic downturn that followed. The fallout from the crisis would lead to a tightening of credit that made homeownership a more distant dream for the subsequent generation, particularly affecting millennials who faced stricter lending standards in its aftermath.

The aftermath of the crisis also saw a significant transformation in the housing market, with a shift from homeownership to a rise in rental properties, as many of the foreclosed homes were bought by investors and turned into rental units. This change helped to stabilize the market somewhat but came at the cost of those who lost their homes and had to shift to renting, unable to own again.

The Golden Age Post-crisis, the investment narrative shifted dramatically. Gold, long treasured for its rarity and symbolic value, emerged as the new safe haven. From 2011 onwards, gold prices soared, buoyed by investors’ desire for tangible assets amidst global financial uncertainty.

This shift was driven by gold’s historical resilience during economic downturns. Unlike real estate, gold was seen as a hedge against inflation and currency devaluation, offering a lifeline in tumultuous times. The yellow metal’s allure was in its simplicity and universality – a universally recognized store of value that transcended borders and economic systems.

In 2006, the real estate market was at its peak, widely recognized as a robust investment option. However, the financial crisis of 2008 led to a dramatic shift, with gold emerging as a safer and more lucrative investment by 2011. This transition highlighted the changing dynamics of investment preferences based on global economic conditions and investor sentiment.

Fast forward to 2024, AI has surged to the forefront of investment trends. This is not just due to the innovative potential of AI technologies but also because of their transformative impact across various industries. Key developments in AI, particularly generative AI (GenAI), have been pivotal in this shift. According to GlobalData’s Thematic Intelligence 2024 TMT Predictions, the GenAI market, which was valued at $1.8 billion in 2022, is expected to grow to $33 billion by 2027, with a compound annual growth rate (CAGR) of 80%. This growth trajectory underscores the rapid adoption and integration of AI technologies across different sectors, indicating a broad and deep impact on the global economy.

MIT Technology Review highlights that AI’s influence is profoundly felt in the entertainment industry, where it is revolutionizing filmmaking processes and marketing strategies. AI technologies like deepfake and generative tools are now mainstream in creating content, indicating the sector’s heavy investment in AI capabilities.

Furthermore, PwC’s 2024 AI Business Predictions emphasize that AI is fundamentally changing how businesses operate. About 73% of US companies have already implemented AI in some capacity, with GenAI leading the way. This widespread adoption is attributed to GenAI’s scalability and versatility across various business functions. PwC predicts that companies that leverage AI effectively will gain a significant competitive edge, especially if they can scale these technologies and integrate them innovatively into their operations.

Gartner offers a more cautious view, suggesting that AI’s transformative impact on global GDP might not be as significant as some predict. They note that while AI is being integrated into products and services to enhance efficiency and solve longstanding problems, its direct contribution to GDP growth may not be easily quantifiable. This perspective introduces a necessary balance to the optimism surrounding AI, highlighting the need for realistic expectations regarding its economic impact.

Here’s an analysis of the trends over time for the search terms “gold,” “real estate,” and “AI” within the United States from December 21, 2006, to January 21, 2024:

- Gold (Yellow Line): The interest in gold has had several peaks and valleys over the time period. Notably, there is a significant spike around 2011, which corresponds with the global financial uncertainties of that time, as investors likely sought refuge in what is traditionally seen as a “safe haven” asset. Following this spike, the interest seems to fluctuate but generally trends downward towards 2024, possibly indicating stabilization in markets or a shift in investment interest to other areas.

- Real Estate (Red Line): The search interest in real estate starts off strong in 2006, which aligns with the historical boom in the housing market. Following the financial crisis of 2008, there’s a noticeable decline, reflecting the burst of the housing bubble. As the market recovers, there’s a gradual increase in interest, with periodic fluctuations likely corresponding to the varying conditions in the housing market, interest rates, and economic factors influencing the affordability and attractiveness of real estate investment.

- AI (Blue Line): The search interest in AI starts relatively low but shows a consistent and sharp increase over time, especially from around 2017 onwards. This upward trajectory reflects the burgeoning interest in AI as the technology advances and becomes more integrated into various industries and facets of daily life. The steep rise towards 2024 suggests a significant surge in public interest and awareness of AI technologies, possibly due to breakthroughs, increased media coverage, or wider implementation in consumer products and business solutions.

The bar graph indicates the average search interest over the entire period, with AI showing the highest average, followed by real estate and then gold. This suggests that while AI had lower interest in the early years, its rapid ascent in later years has significantly outpaced interest in the more traditional investment assets of gold and real estate.

Overall, the chart illustrates a shift in public interest from traditional investment options like gold and real estate to more innovative and technological areas such as AI, which has captured the imagination and attention of the public and investors alike in recent years. This could reflect broader trends in the economy and society, with increasing recognition of the potential for AI to drive future growth and innovation.

The AI Revolution Fast forward to the present day, and a new player has taken center stage: Artificial Intelligence. AI’s ascent in the investment world has been meteoric, propelled by its vast potential and futuristic appeal. Unlike real estate and gold, AI represents the pinnacle of forward-thinking investment – a bet on the future of technology and its potential to reshape every aspect of our lives.

The rise of AI as a top investment trend is a testament to its technological capabilities and its widespread application across various industries. While it’s important to recognize the potential of AI, it’s equally crucial to approach its economic and investment implications with a balanced perspective, considering both its transformative potential and the realistic challenges in quantifying its impact on broader economic indicators like GDP growth.

The appeal of AI as an investment lies in its transformative capabilities. From automating mundane tasks to revolutionizing industries like healthcare, finance, and entertainment, AI’s reach is vast and growing. Its potential for scalability and adaptability makes it a uniquely compelling investment opportunity, offering prospects of unprecedented growth and innovation.

A New Investment Paradigm As we stand at the crossroads of this new era, the investment landscape presents a fascinating tapestry of change. The transition from real estate to gold, and now to AI, reflects the evolving nature of value and security in the eyes of investors. While real estate and gold offered tangible assets and traditional security, AI presents a dynamic and intangible frontier, ripe with possibilities and risks alike.

In this new paradigm, the savvy investor is one who recognizes the potential of AI, while also appreciating the lessons of the past. Balancing the timeless allure of gold and the steadfast nature of real estate with the innovative spirit of AI could be the key to navigating the exciting and uncharted waters of future investments.

As we look ahead, one thing remains clear: the only constant in the world of investment is change, and the ability to adapt and embrace this change will be the hallmark of success in the years to come. Here’s your key to avoiding economic stagnation while gaining from persistent price inflation:

Get a free list of the Top 10 Investments for 2024 in A.I., precious metals, real estate and the very newest and emerging opportunities — from the team that predicted the meteoric rise of Bitcoin more than 10 years ago.

Get the free report. Fill out the online form.

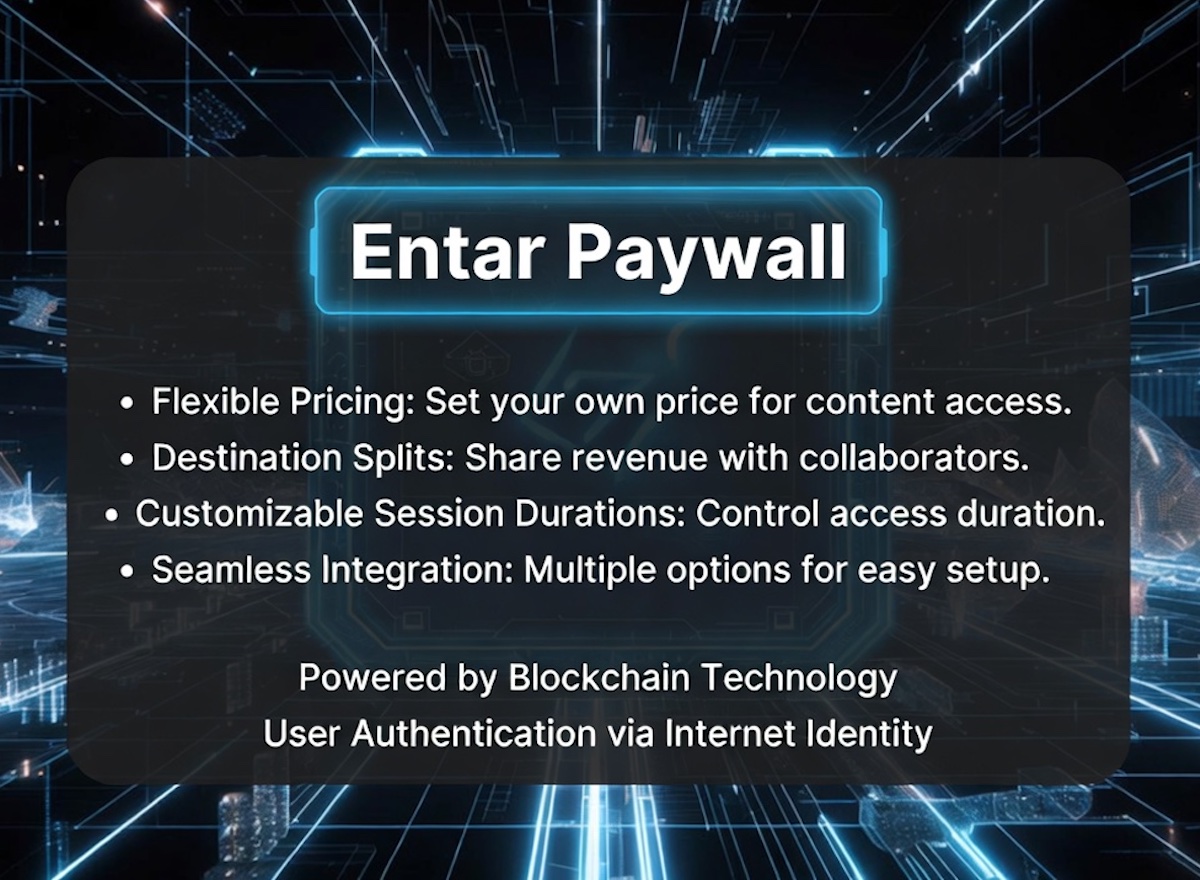

Copyright © This free information provided courtesy Entar.com with information provided by Corey Chambers, Broker DRE 01889449. We are not associated with the seller, homeowner’s association or developer. For more information, contact 888-240-2500 or visit WeSellCal.com Licensed in California. All information provided is deemed reliable but is not guaranteed and should be independently verified. Text and photos created or modified by artificial intelligence. Properties subject to prior sale or rental. This is not a solicitation if buyer or seller is already under contract with another broker.